Accounting Tasks for Small Businesses

Staying on top of your finances with regular checks is key to avoiding costly mistakes and staying compliant with tax and financial regulations. Here’s a breakdown of essential accounting tasks for your small business:

Daily Accounting Tasks

- Reconcile Cash and Receipts: At the end of each day, ensure your cash transactions and receipts match your sales and purchases. This helps maintain accuracy in your financial records.

- Update Financial Data: Input all sales, expenses, and transactions into your accounting software daily. This keeps your financial records up to date and offers a clear picture of your business’s financial health.

- Record Inventory Received: Make sure to log all incoming inventory accurately so you can manage product costs and stock levels effectively.

- Review and Reconcile Transactions: Cross-check your bank statements against your records to ensure there are no discrepancies. This helps prevent errors and fraud.

- Track and Categorize Expenses: Record expenses daily and categorize them properly to better understand where you can cut costs or improve spending efficiency.

Weekly Accounting Tasks

- Record Payments: Log any payments you receive—whether through cash, checks, or digital transactions. This keeps you on top of your cash flow.

- Invoice Clients: Ensure invoices are sent promptly and track any outstanding payments. Follow up on overdue invoices to maintain healthy cash flow.

- Review Employee Timesheets: Verify employee hours to ensure payroll accuracy and avoid any discrepancies in pay.

- Monitor Accounts Payable: Stay on top of bills and payments due, ensuring the timely settlement of vendor debts.

- Bank Reconciliation: Regularly review your bank account for irregular transactions or fees to prevent any surprises.

Monthly Accounting Tasks

- Track Budgets and Variances: Compare actual income and expenses with your budget. This allows you to spot any financial discrepancies early on.

- Pay Bills: Ensure timely payment of vendor bills to avoid late fees and maintain strong business relationships.

- Backup Financial Data: Backing up your accounting data ensures you’re protected from potential loss due to technical issues, especially around tax season.

- Review Financial Statements: Analyze your income statement, balance sheet, and cash flow statement for trends or issues that need addressing.

- Assess Tax Liabilities: Stay on track with any upcoming sales tax or payroll tax liabilities.

Quarterly Accounting Tasks

- Maintain Financial Transparency: Share financial insights with key stakeholders to support informed decision-making.

- Ensure Compliance: Verify that your financial statements adhere to tax regulations and industry standards (e.g., GAAP or IFRS).

- Document Key Transactions: Keep detailed records of significant transactions for tax filing and audit purposes.

- Review Accounts Receivable and Payable: Ensure both receivables and payables are accurate and up-to-date.

- Hold a Financial Review Meeting: Meet with management to discuss financial results, address discrepancies, and implement necessary changes.

Annual Accounting Tasks

- Audit and Year-End Tax Returns: Conduct an audit and ensure your year-end tax returns are completed and filed on time.

- Prepare Year-End Financial Statements: Prepare a full-year financial report to reflect business performance, necessary for tax filings and future planning.

- Evaluate Financial Performance: Assess the past year’s financial performance to identify successes and areas for improvement, setting the stage for the year ahead.

- Update Depreciation Schedules: Review and adjust depreciation schedules to reflect asset value changes over the year.

- Finalize Next Year’s Budget: Create a detailed budget for the upcoming year using insights from the current year’s financial performance.

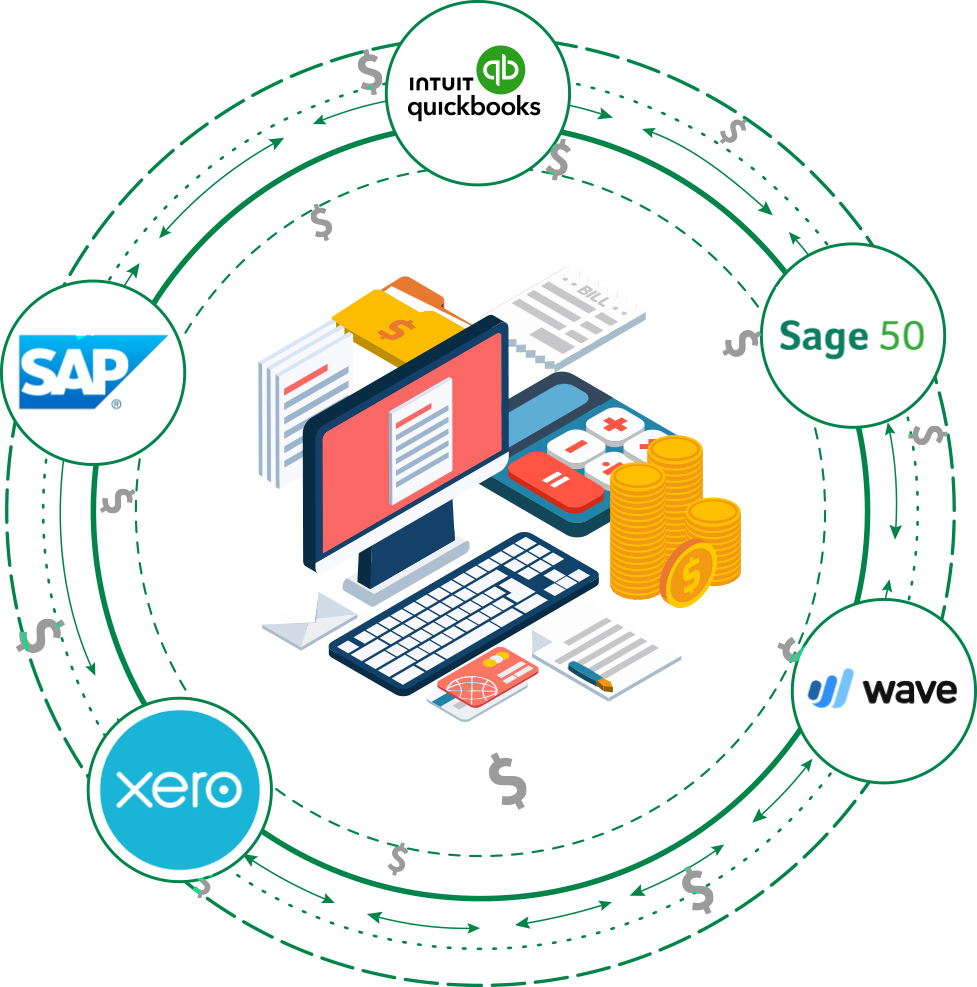

Top 5 Accounting Software for Your Small Business

Choosing the right accounting software can significantly streamline your business operations, reduce errors, and save time. Here are the five top options for small businesses:

- QuickBooks Accounting Software: QuickBooks is versatile and ideal for small businesses, offering features like expense tracking, invoicing, and financial reporting. It integrates well with third-party apps and offers cloud-based options for flexibility.

- Sage 50 Accounting Software: Designed for small to medium-sized businesses, Sage 50 combines desktop software with cloud integration, offering robust accounting features and remote access.

- Wave Accounting Software: A free, cloud-based solution for small businesses, Wave offers powerful features like invoicing and expense tracking. Despite being free, it offers solid security and reliability for startups and solo entrepreneurs.

- Xero Accounting Software: Xero is a cloud-based tool perfect for small to medium-sized businesses, automating bookkeeping tasks and offering real-time financial insights. Its user-friendly interface includes everything from bank reconciliation to payroll management.

- SAP Accounting Software: Part of a larger ERP system, SAP is suited for small businesses that require advanced financial reporting and data management. Its powerful features cater to enterprises needing in-depth financial analysis.

Why Choose QuickBooks (Desktop & Online) Accounting Software?

Choosing between QuickBooks Desktop and Online depends on your specific business needs for data access, security, and collaboration.

- QuickBooks Desktop: Ideal for businesses seeking control over their accounting data, QuickBooks Desktop offers enhanced security, reliable performance, and offline capabilities. It’s perfect for businesses requiring extensive customization and industry-specific features.

- QuickBooks Online: For businesses needing remote access and real-time collaboration, QuickBooks Online provides cloud-based functionality, allowing you to track expenses and collaborate seamlessly from anywhere.

Why Choose BigXperts for Your Accounting Needs?

At BigXperts, we’re committed to providing personalized, reliable accounting solutions with over 10 years of industry expertise. Our team of certified professionals ensures your finances are in expert hands, with a focus on accuracy, transparency, and client satisfaction.

. Over 10 years of experience

. Certified, highly skilled accounting experts

. Tailored financial solutions for individuals and businesses

. Committed to accuracy and reliability

. Client-first approach ensuring satisfaction every step of the way.

Our Services

We Listen, We Discuss, We Advise, and We Solve Your Accounting Software Errors

Financial Reporting

Accounts Reconciliation

Payroll Management

Budgeting & Forecasting

Accounts Payable

Inventory Management

Tax Preparation